Virginia Division of Legislative Services

DLS Report

Number 1 -- July 1999

Virginia's Revenue Stabilization Fund

Joan E. Putney

Joan E. Putney is a senior attorney in the Finance and Government section of the Division of Legislative Services.

With Virginia's economic tide riding so high in recent years, shortfalls in revenues seem distant memories. But as recently as the early 1990s, an economic downturn caused a revenue shortfall that approached $2 billion, forcing significant budget cuts and prompting, in the 1990 Appropriation Act, a study by the Joint Legislative Audit and Review Commission.

As a result, Virginia's Revenue Stabilization Fund (often referred to as the "rainy day fund") was created by means of an amendment to the Virginia Constitution. This report covers the history and the constitutional language requiring the establishment of a rainy day fund, including the formula used to fund it and the circumstances under which it may be used. Also included is a comparison of other states with rainy day or similar funds.

History

During the 1980s, a general fund revenue reserve was routinely appropriated as part of Virginia's biennial budget. The amounts appropriated rose from a low of $8.5 million in 1980 to a high of $77.5 million in 1989. The amount increased primarily as a hedge against the unknown effects of federal tax reform and a potential downturn in the economy.

As economic conditions became more uncertain, the Governor sent down budget amendments in the 1990 General Assembly Session that called for a $200 million revenue reserve. The General Assembly agreed to an unappropriated balance of slightly more than $200 million, which was financed in part by budget reductions of $95 million, but authorized the money to be used for a second-year salary increase for state employees if it was not needed to offset the effect of an economic slowdown or federal tax policy changes.

JLARC Study

In that same Appropriation Act for 1990, the Joint Legislative Audit and Review Commission (JLARC) was directed to "review Virginia's executive system of financial planning, execution and evaluation." In the fall of 1990, JLARC formed a special subcommittee to examine the executive budget process. That subcommittee directed JLARC staff to study the possibility of establishing a rainy day fund for Virginia and to propose various options and a framework for legislation to create such a fund.

JLARC staff gathered information about rainy day funds from the National Conference of State Legislatures (NCSL) and the National Association of State Budget Officers (NASBO). They also conducted a 49-state telephone survey and interviewed executive and legislative staff throughout Virginia.

Constitutional Amendment

The JLARC report (Senate Document No. 24, 1991) proposed a constitutional amendment "to ensure that the [rainy day] fund would become a permanent part of the Commonwealth's budgetary system." JLARC found a constitutional amendment advantageous for three reasons: (i) an amendment is more permanent than a statute; (ii) an amendment cannot be overridden by an appropriation act; and (iii) a constitutional amendment avoids possible constitutional problems with a statute-based fund.

JLARC found but four other states with constitution-based rainy day funds, noting that two of the four had fund balances, measured as a percentage of general fund appropriations, among the highest in the country. In recommending the constitutional amendment, JLARC and the subcommittee noted that "once ratified by the people, constitutional provisions are rarely repealed," thus ensuring the permanence of the fund.

A rainy day fund created by statute could be overridden or modified by the appropriation act, thus weakening the fund and potentially endangering its longevity. In the interests of protecting the fund and enhancing the long-term interest of the Commonwealth, the subcommittee found the constitutionally-based fund preferable.

Finally, Sections 7 and 8 of Article X of the Constitution raise potential barriers to the establishment of a statute-based rainy day fund. Section 7 forbids appropriations that are payable more than two years and six months after the end of the session at which the law is enacted authorizing the appropriation. Section 8 states: "No other or greater amount of tax or revenues shall, at any time, be levied than as may be required for the necessary expenses of the government, or to pay the indebtedness of the Commonwealth."

Separate and Distinct

The special subcommittee discovered that the majority of states with rainy day funds have made their funds separate and distinct from their general funds. Consistent with the subcommittee's concern for the long-term stability and integrity of the fund, and with its intent that the General Assembly control the maintenance and administration of the fund, the subcommittee recommended that the proposed Revenue Stabilization Fund be separate and distinct from Virginia's general fund.

The special subcommittee decided to propose legislation in the 1991 General Assembly Session calling for an amendment to Article X, Section 8 of the Constitution of Virginia. The amendment was agreed to by the General Assembly during the 1991 and 1992 Sessions, was ratified by the voters in November of 1992, and took effect on January 1, 1993.

Constitutional LanguageThe applicable provisions in Article X, Section 8 read as follows: The General Assembly shall establish the Revenue Stabilization Fund. The Fund shall consist of an amount not to exceed ten percent of the Commonwealth's average annual tax revenues derived from taxes on income and retail sales as certified by the Auditor of Public Accounts for the three fiscal years immediately preceding. The Auditor of Public Accounts shall compute the ten percent limitation of such fund annually and report to the General Assembly not later than the first day of December. "Certified tax revenues" means the Commonwealth's annual tax revenues derived from taxes on income and retail sales as certified by the Auditor of Public Accounts. The General Assembly shall make deposits to the Fund to equal at least fifty percent of the product of the certified tax revenues collected in the most recently ended fiscal year times the difference between the annual percentage increase in the certified tax revenues collected for the most recently ended fiscal year and the average annual percentage increase in the certified tax revenues collected in the six fiscal years immediately preceding the most recently ended fiscal year. However, growth in certified tax revenues, which is the result of either increases in tax rates on income or retail sales or the repeal of exemptions therefrom, may be excluded, in whole or in part, from the computation immediately preceding for a period of time not to exceed six calendar years from the calendar year in which such tax rate increase or exemption repeal was effective. Additional appropriations may be made at any time so long as the ten percent limitation established herein is not exceeded. All interest earned on the Fund shall be part thereof; however, if the Fund's balance exceeds the limitation, the amount in excess of the limitation shall be paid into the general fund after appropriation by the General Assembly. The General Assembly may appropriate an amount for transfer from the Fund to compensate for no more than one-half of the difference between the total general fund revenues appropriated and a revised general fund revenue forecast presented to the General Assembly prior to or during a subsequent regular or special legislative session. However, no transfer shall be made unless the general fund revenues appropriated exceed such revised general fund revenue forecast by more than two percent of certified tax revenues collected in the most recently ended fiscal year. Furthermore, no appropriation or transfer from such fund in any fiscal year shall exceed more than one-half of the balance of the Revenue Stabilization Fund. The General Assembly may enact such laws as may be necessary and appropriate to implement the Fund. |

Calculations

The first paragraph added by the amendment to Article X, Section 8 requires the establishment of the rainy day fund and sets a limit on the amount of revenues which the fund may hold. That limit is ten percent of Virginia's average annual income and retail sales tax revenues ("certified tax revenues") for the three fiscal years immediately prior to a December certification by the Auditor of Public Accounts. For FY 1998, the calculation to determine the maximum fund amount looked like this (all dollar amounts in millions):

.10 X [($6,425.6 + $6,987.1 + $7,775.8) / 3] = $706.3

(FY 96) (FY 97) (FY 98) (FY 98

Maximum)

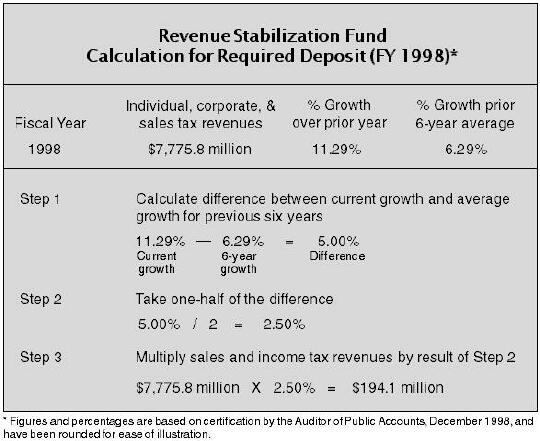

The second paragraph contains the formula for calculating the deposit to be made to the fund in years of "above-average" growth, defined as any growth exceeding the six-year average growth rate of the certified tax revenues. Essentially, the intent is to set aside in the rainy day fund half of the extraordinary growth in any fiscal year. The formula to calculate this amount, in FY 1998, is shown on page 5.

With the FY 1998 amount that will actually be deposited in the fund in FY 2000, a total amount of $552.5 million has been committed to the fund. The Auditor of Public Accounts will certify a FY 1999 payment in December, which could be in the range of $125 million.

The Revenue Stabilization Fund is a separate fund which earns and retains its own interest. It is invested just as any other general fund account would be invested. Additional appropriations may be made to the fund at any time through the normal budget process (there have been no such appropriations). Should the fund amount exceed the ten percent limitation, the excess would go into the general fund.

Transfers

The third paragraph added to Article X, Section 8 explains under what circumstances money may be transferred out of the fund and limits the amount that may be transferred. The fund may be accessed only if a revenue forecast overstates collections by more than two percent of the certified tax revenues for the prior fiscal year, and then only one-half of the projected shortfall may be covered by the fund. In addition, no more than one-half of the fund may be transferred to the general fund in any fiscal year. To date, there have been no transfers from the Virginia Revenue Stabilization Fund to the general fund.

In addition to providing a cushion in the event of an unexpected economic downturn, rainy day funds in general get high marks from the bond market. They are viewed as another means of payment for a state's obligations. However, under current strong economic conditions, a rainy day fund's impact on a state's bond rating is not as significant.

Other States' Rainy Day Funds

A true comparison of Virginia's Revenue Stabilization Fund and other states' rainy day funds is virtually impossible for a variety of reasons. First of all, some of the funds are mandated through state constitutions, like Virginia's, and some are only provided for by statute. Statutes are easily changed or overridden by budget bills or other statutes and are sometimes even ignored.

Second, some of the funds consist of appropriated revenues and some are unappropriated, meaning they are merely surplus revenues. Third, there is variation in the purposes for which funds may be used. Some states allow the money to be used for revenue shortfalls or some other budget deficit. Other states allow it to be used for any emergencies. A few states have no limits: the money may be used for any purpose the legislature approves.

Finally, most of the states having rainy day funds have capped their size. Some use a percentage to determine the cap, such as five or ten percent, and others set the cap at a specified dollar amount. If a percentage is used, it may be based on general fund appropriations, prior year revenues, expenditures, or some other base.

According to a NCSL 1998 report, 45 states and Puerto Rico had created 51 rainy-day-type funds. Of those, only seven had created such funds through a constitutional provision. The remaining 39 authorized their funds via statute. Four states have more than one rainy day fund: Alaska, Florida, Iowa and South Carolina.

Virginia is one of five states in which deposits to the fund are based on a formula that uses some form of income growth to determine the amount. The remaining states base deposits on year-end surpluses, appropriations, or some combination of the two.

Thirteen states have capped the size of their funds at five percent of some base, with five states capping it at ten percent. Other caps range from two percent (New York) to 7.5 percent (Mississippi). Amounts in the funds range from a high of $3.051 billion in Alaska to a low of $0.00 in Alabama, Kansas, Louisiana, North Dakota, and Wisconsin.

Of the five states surrounding Virginia, all of the rainy day funds were created by statute. In Maryland, Kentucky and Tennessee, the deposits into their fund are made by appropriation. In North Carolina, the deposit is a portion of any unreserved credit balance at the end of the fiscal year; in West Virginia, it is a portion of all surplus revenues accrued during the fiscal year just ended. The current amount (in millions) in each fund:

| State |

Balance (millions)

|

|

Maryland Virginia North Carolina Kentucky Tennessee West Virginia |

$635.8 552.5*

322.0** 242.0 101.4 71.6 |

* Deposited,

reserved, or designated for deposit, including interest, through FY 1998.

** $200 million was withdrawn from the fund by the North Carolina legislature

during its 1999 Session.

Conclusion

In simplest terms, the Revenue Stabilization Fund is:

(i) intended to offer a financial cushion in the event of an unexpected downturn in the economy;

(ii) funded by setting aside one-half of the above-average revenue growth in a given fiscal year (plus interest earned);

(iii) subject to a withdrawal only if the general fund revenue projection is overstated by more than two percent of the prior year's income and sales tax collections (anticipated economic downturns which are built into a revenue forecast do not trigger a withdrawal); and

(iv) limited in that no more than one-half of the fund may ever be removed in any given fiscal year, which effectively ensures the fund's permanence.

While a majority of the states have some type of rainy day fund, no two funds are the same in how they are created, how they are funded, and for what purposes they may be used. Virginia's Revenue Stabilization Fund, unusual in being constitutionally-based, continues to grow as the state's economy continues to grow at record levels, thereby bolstering Virginia's financial stability and vitality.

As with all rainy day funds, Virginia's Fund is intended to serve as an additional budget tool. Until the time comes when there is a serious, unexpected economic downturn, the fund's effectiveness in cushioning a revenue shortfall remains unknown.

|

Published by the Division of Legislative Services

E.M. Miller,

Jr., Director

Special Projects |